Changes in this Release

•Fix - Duplicate Check in Donation Import

•Enhance - optimize Group Counts Stats Report

•Enhance - optimize Recurring Donation Create

•IMPORTANT - Canadian tax receipts - new website www.cra-arc.gc.ca/charitiesandgiving

Canadian Users of BasicFunder

Canada Revenue Agency Receipts Requirements

We have learned that CRA has rejected donor receipts that do not contain CRA's new required website. http://www.cra-arc.gc.ca/charitiesandgiving. We subscribe to CRA email newsletters concerning changes, but have never read about this change, maybe some of you have, but it is news to us!

Learn about all CRA requirements at their website: http://www.cra-arc.gc.ca/charitiesandgiving

Examples of acceptable receipts can be seen at CRA's website here:

English Examples:

http://www.cra-arc.gc.ca/chrts-gvng/chrts/pbs/rcpts-eng.html

French Examples:

http://www.cra-arc.gc.ca/chrts-gvng/chrts/pbs/rcpts-fra.html

Changes to BasicFunder Premier - version 4.50 released Nov 27, 2013

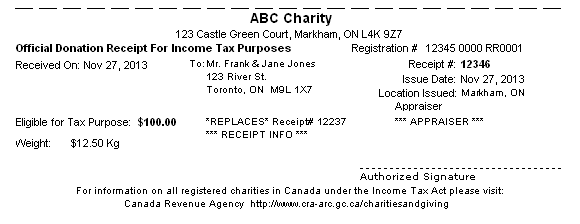

In version 4.50 we have updated our official built-in tax receipts to include the following on the bottom of the receipt:

For information on all registered charities in Canada under the Income Tax Act please visit:

Canada Revenue Agency http://www.cra-arc.gc.ca/charitiesandgiving

Prior to 4.50 you had to put the CRA website details into one of the receipt message lines. This needs to be removed effective version 4.50.

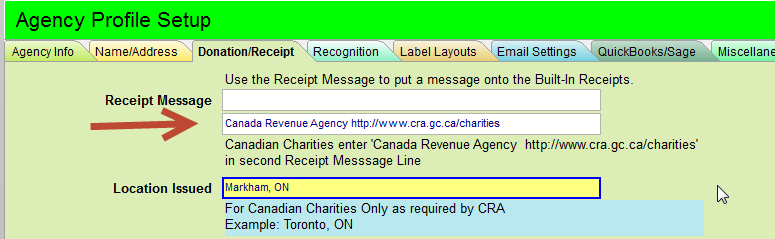

BasicFunder Agency Info - Receipt Tab prior to 4.50 - remove the message

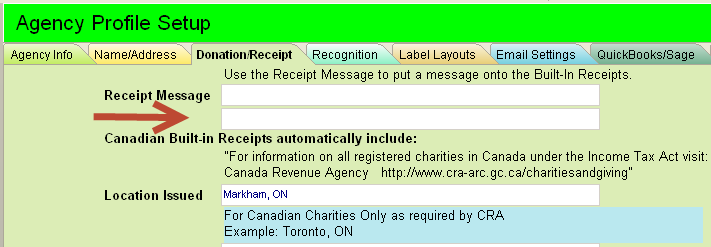

BasicFunder Agency Info - Receipt Tab current version 4.50 - we now explain that this will automatically show up if you use the built-in receipts.

Here is what the Test Print of the new official built-in tax receipt looks like:

IMPORTANT

The new receipt will consume more space on the page, you may need to adjust the content of your letter to ensure everything fits on the page.

If you have designed your own receipts you may need to make changes to satisfy CRA requirements.

|